Change Your Economic Future with Expert Tips on Credit Repair

Change Your Economic Future with Expert Tips on Credit Repair

Blog Article

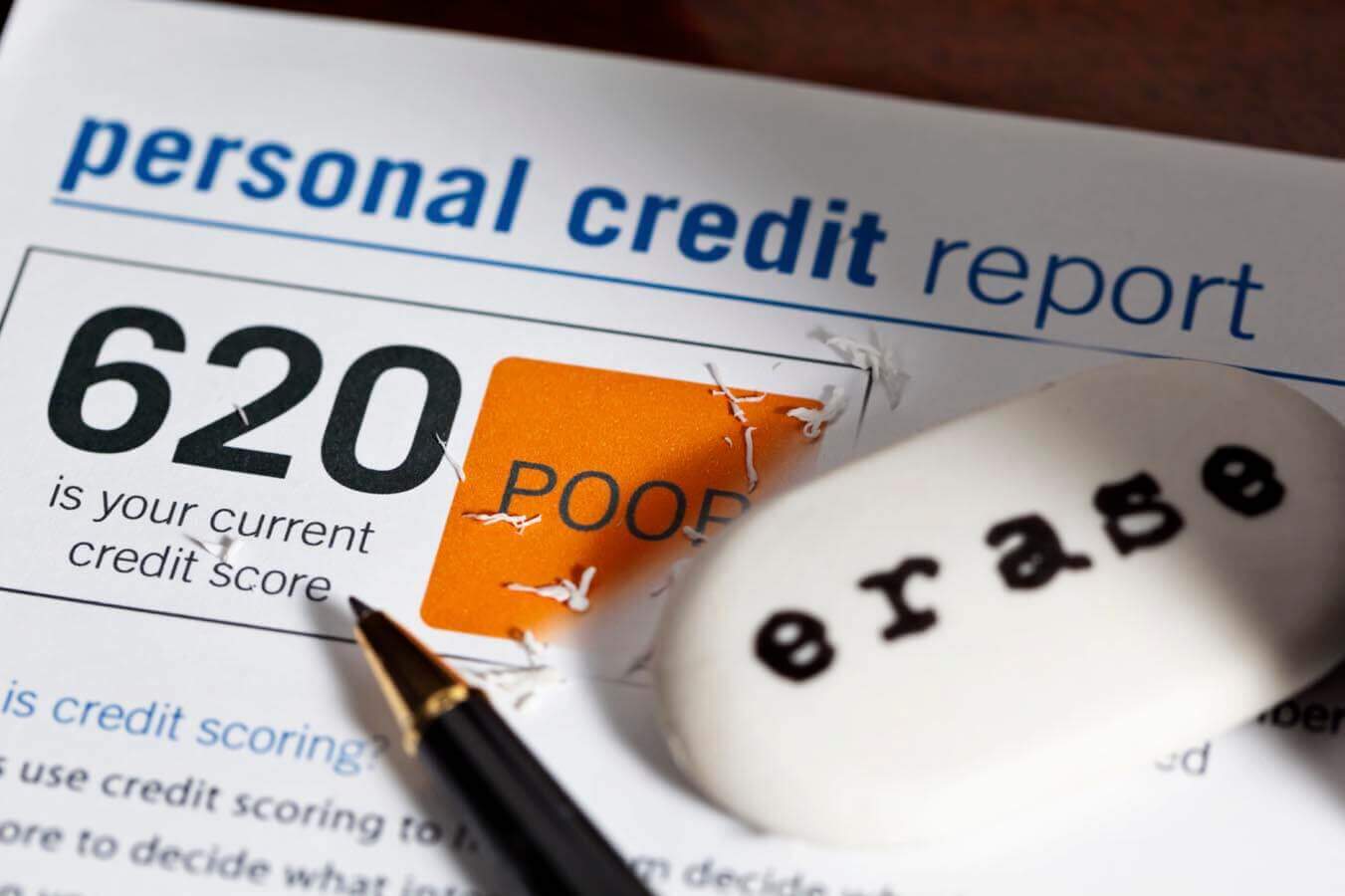

A Comprehensive Guide to Exactly How Credit History Repair Can Change Your Credit History

Comprehending the ins and outs of credit repair is essential for anyone looking for to boost their economic standing. By resolving concerns such as repayment history and credit report use, individuals can take positive steps towards improving their credit score ratings.

Comprehending Credit History

Comprehending credit report scores is crucial for any individual seeking to enhance their financial wellness and gain access to better loaning options. A credit history is a numerical depiction of an individual's credit reliability, usually varying from 300 to 850. This score is produced based on the info contained in a person's credit rating record, that includes their credit report, impressive debts, repayment background, and kinds of charge account.

Lenders utilize credit report to analyze the risk connected with offering money or prolonging credit. Higher ratings show lower danger, often resulting in extra favorable finance terms, such as lower rate of interest and higher credit line. On the other hand, reduced credit report can result in higher passion rates or denial of credit report completely.

Several elements affect credit rating, consisting of payment history, which makes up roughly 35% of the rating, adhered to by debt usage (30%), length of credit report (15%), sorts of credit report in operation (10%), and new credit report queries (10%) Comprehending these elements can empower individuals to take workable steps to improve their scores, inevitably boosting their monetary chances and stability. Credit Repair.

Usual Debt Issues

Several people face common credit concerns that can impede their monetary progress and affect their credit rating scores. One widespread problem is late repayments, which can substantially harm debt rankings. Also a solitary late repayment can remain on a credit scores report for numerous years, impacting future loaning capacity.

Identity burglary is an additional severe worry, potentially leading to deceptive accounts appearing on one's credit scores report. Dealing with these typical credit score issues is important to improving financial health and developing a strong credit score account.

The Debt Repair Refine

Although credit repair work can appear challenging, it is an organized procedure that individuals can take on to enhance their credit rating and rectify errors on their credit records. The initial step includes obtaining a duplicate of your credit history report from the 3 major credit report bureaus: Experian, TransUnion, and Equifax. Testimonial these records thoroughly for errors or inconsistencies, such as inaccurate account information or obsolete information.

As soon as errors are identified, the following step is to contest these errors. This can be done by getting in touch with the credit history bureaus straight, supplying documentation that sustains your case. The bureaus are called for to check out conflicts within thirty days.

Maintaining a consistent settlement background and managing credit score utilization is also essential during this process. Checking your credit history regularly ensures ongoing accuracy and assists track enhancements over time, reinforcing the efficiency of your debt fixing efforts. Credit Repair.

Advantages of Debt Fixing

The advantages of credit scores repair work prolong far beyond simply boosting one's credit history; they can dramatically impact financial security and possibilities. By attending to errors and unfavorable things on a credit history record, people can enhance their credit reliability, making them much more eye-catching to loan providers and check my source financial organizations. This improvement usually causes better interest prices on finances, lower premiums for insurance coverage, and increased opportunities of approval for bank card and mortgages.

In addition, credit score repair can assist in accessibility to vital solutions that require a credit check, such as renting a home or getting an energy service. With a much healthier credit history profile, individuals might experience enhanced self-confidence in their economic choices, permitting them to make larger acquisitions or financial investments that were previously unreachable.

In addition to concrete monetary advantages, credit report fixing fosters a sense of empowerment. Individuals take control of their monetary future by proactively handling their credit score, resulting in even more educated selections and better economic proficiency. Overall, the advantages of credit repair work add to a more stable financial landscape, ultimately advertising long-term financial development and individual success.

Selecting a Credit Repair Solution

Choosing a credit score repair work service requires mindful factor to consider to make sure that individuals receive the support they require to enhance their monetary standing. Begin by researching potential firms, concentrating on those with favorable client evaluations and a tested track record of success. Openness is crucial; a trustworthy service should plainly describe their costs, timelines, and procedures in advance.

Next, verify that the credit rating fixing solution adhere to the Credit rating Fixing Organizations Act (CROA) This federal law protects consumers from deceitful methods and collections guidelines for credit repair service solutions. Avoid firms that make unrealistic pledges, such as assuring a particular rating increase or declaring they can get rid of all unfavorable things from your report.

In addition, consider the level of consumer support supplied. A good credit rating repair work solution should supply personalized support, permitting you to ask inquiries and receive timely updates on your development. Seek solutions that offer an extensive evaluation of your credit scores report and establish a tailored approach tailored to your specific situation.

Eventually, selecting the ideal credit rating repair service can result in considerable enhancements in your credit report, equipping you to take control of your monetary future.

Final Thought

In conclusion, efficient credit report repair work approaches can dramatically enhance credit report by dealing with typical issues such as late payments and errors. A detailed understanding of credit rating factors, combined with the involvement of trustworthy credit fixing solutions, helps with the negotiation of adverse products and ongoing progress surveillance. Inevitably, the successful renovation of credit history not only brings about much better funding terms but additionally cultivates greater economic chances and stability, emphasizing the significance of proactive credit monitoring.

By dealing with concerns such as repayment history and debt use, individuals can take positive actions towards enhancing their credit score scores.Lenders make use of credit report scores to evaluate the threat associated with offering money or prolonging credit.One more constant issue is high credit score usage, specified as the proportion of current credit score card equilibriums to site link total offered debt.Although credit history fixing can seem complicated, it is an organized procedure that individuals can carry out to enhance their debt scores and rectify inaccuracies on their credit report records.Following, validate that the credit scores repair work solution complies with the Debt Repair Organizations Act (CROA)

Report this page